Deskera ERP will assist its customer remain compliant with applicable tax system. Before the 6 GST that was implemented in 2015 Malaysia levied a Sales Tax and a Service Tax.

Difference Between Sst Gst Sst Vs Gst In Malaysia 2020 Updated

Sunday 12 Aug 2018.

. Governed by the Sales Tax Act 2018 and the Service Tax Act 2018 the Sales Tax was a federal consumption tax imposed. The debate surrounding how prices will fluctuate after SST replaces GST seems split two ways with a portion of Malaysians expecting prices of goods to drop and some others believing otherwise. Documentary Video Short Research by MS38 -2018-2019.

The Malaysian government replaced GST with SST as of September 1 2018. 2018-08-12 - By DR CHOONG KWAI FATT MALAYSIAs decision to revert to the Sales and Service Tax SST from the Goods and Services Tax GST will result in a higher disposable income due to relatively lower prices it will incur in most goods and services. Malaysia Sales Service Tax - SST was re-introduced on 1 Sep 2018.

So one of their biggest pledges was to re-instate SST once they came into power. This was announced by Finance Minister Lim Guan Eng on 16 July 2018 who informed that the Bill on SST will be passed in Parliament sometime in August. Pakatan Harapan had consistently said that GST had burdened the rakyat.

Malaysia has approved the abolition of the Goods and Services Tax GST introduced three years ago. Sales and Services Tax SST applicable from Sep 1 2018 replaces it. MALAYSIAs decision to revert to the Sales and Service Tax SST from the Goods and Services Tax GST will result in a higher disposable.

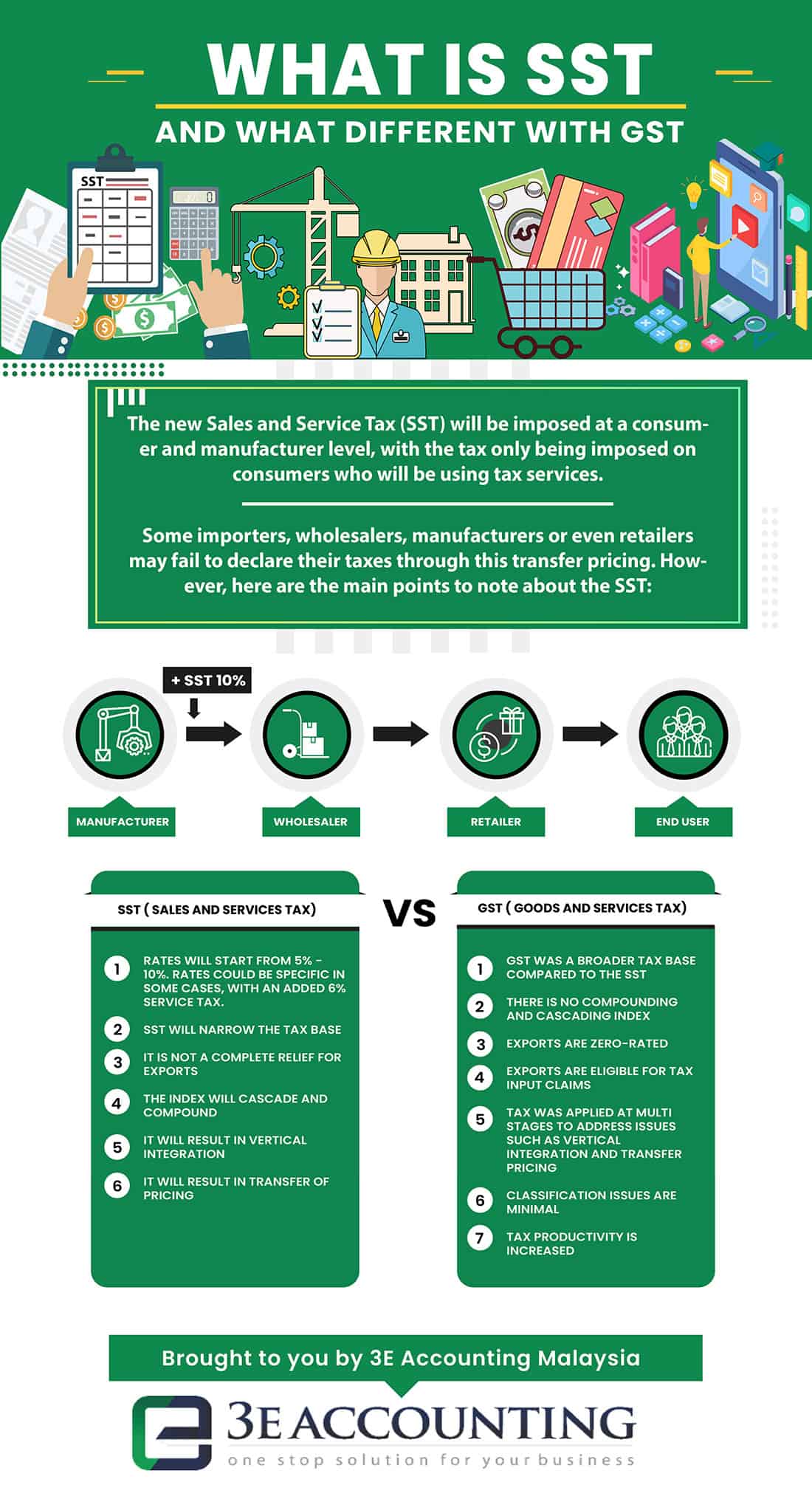

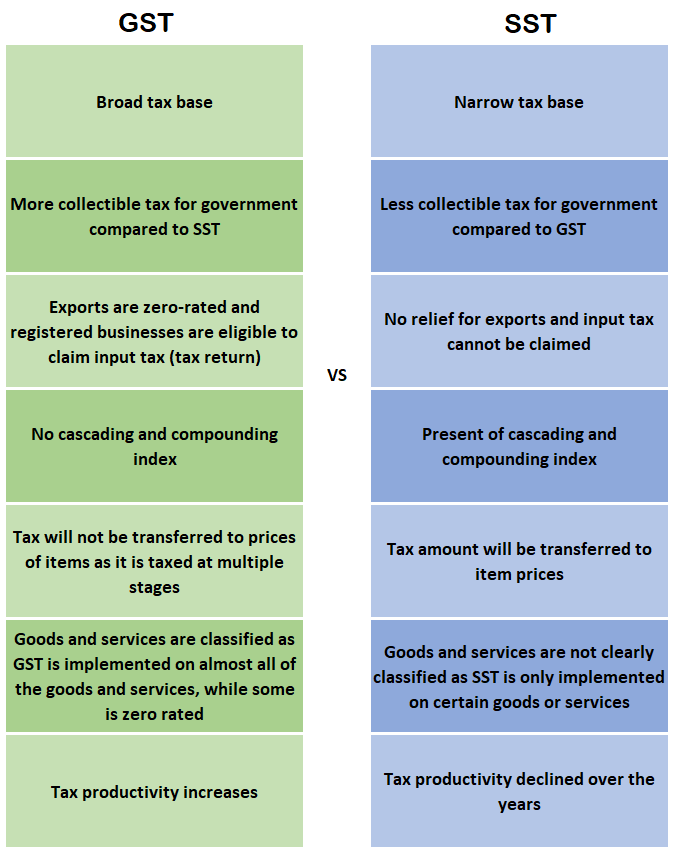

Broad-based levied on all goods and services including imports unless specifically excluded Levied on all locally manufacturedimported goods and certain prescribed services. The Finance Minister stated that the SST bill will be passed in Parliament at around August. The answer to this debate isnt so straightforward as it.

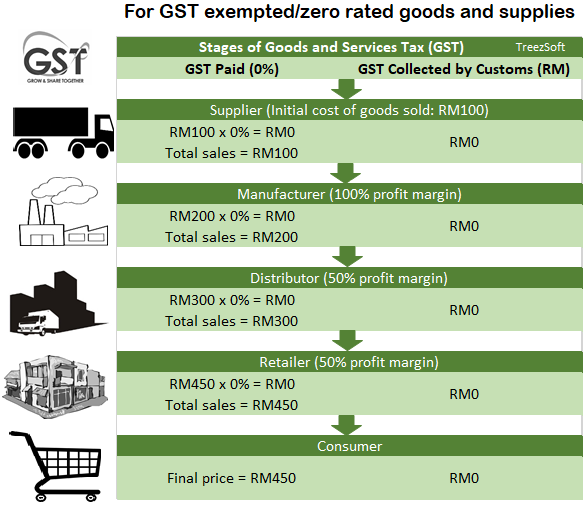

Its the first time since the Seventies when the Service Tax Acts 1975 that there isnt any kind of consumption tax imposed but as the government has been saying from the start it will end. GST as they promised would be. GST is charged on all taxable supplies of goods and services in Malaysia except those goods and services that are explicitly exempted.

The move to reimplement GST which replaced the sales and service tax SST in April 2015 but was then scrapped in favour of SST in September 2018 when the Pakatan Harapan government took over the. Putra Business School Manager of Entrepreneurship and Community Development and Impact. Broad-based levied on all goods and services including imports unless specifically excluded Levied on all locally manufacturedimported goods and certain prescribed services.

MALAYSIAs decision to revert to the Sales and Service Tax SST from the Goods and Services Tax GST will result in a higher disposable income due to relatively lower prices it will incur in most goods and services. SST vs GST in Malaysia. KUALA LUMPUR June 3 Car prices in Malaysia are expected to increase by one to three per cent following the switch back to the goods and services tax GST the opposite effect compared to the aftermath of the implementation of the sales and service tax SST back in 2018 says AmInvestment Bank Bhd.

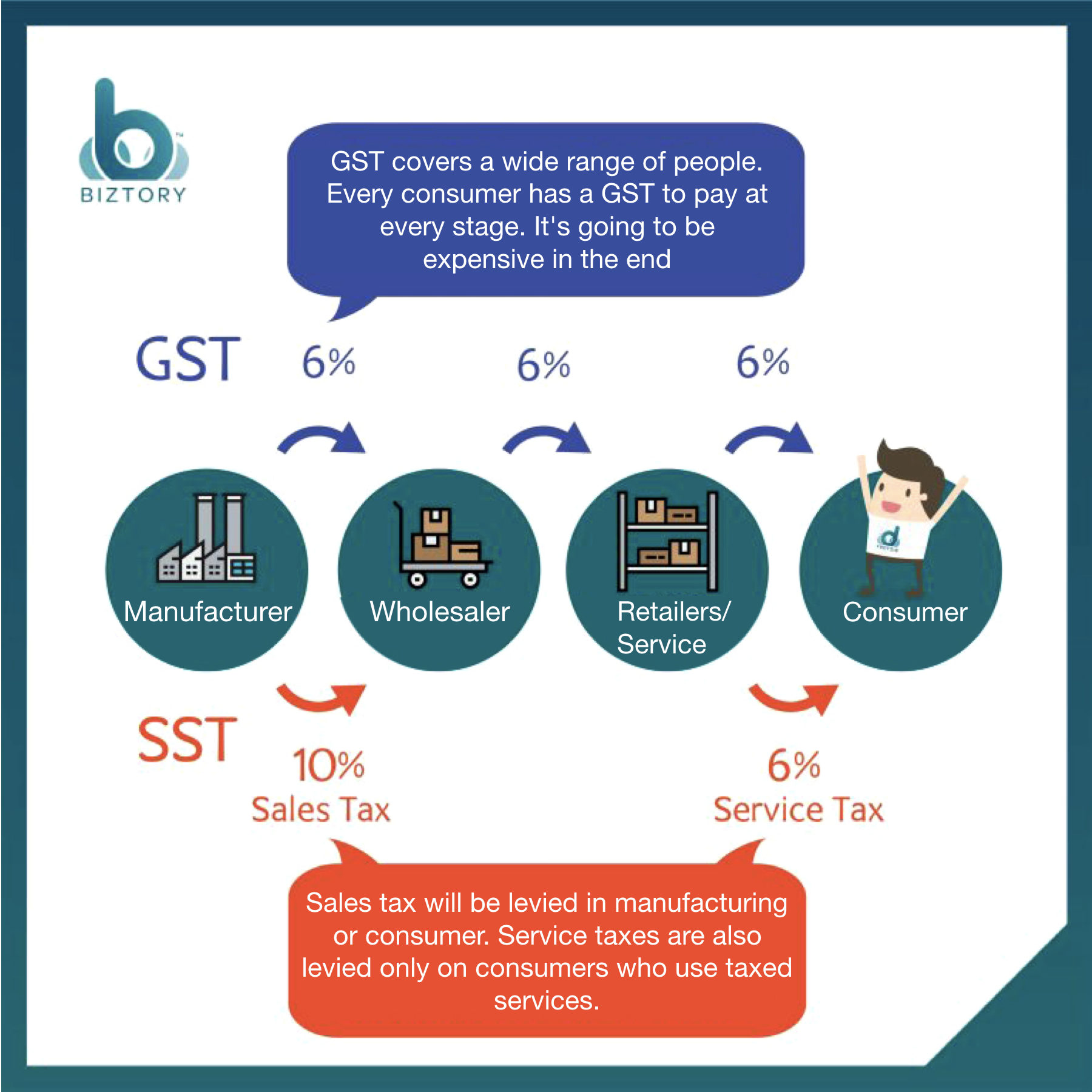

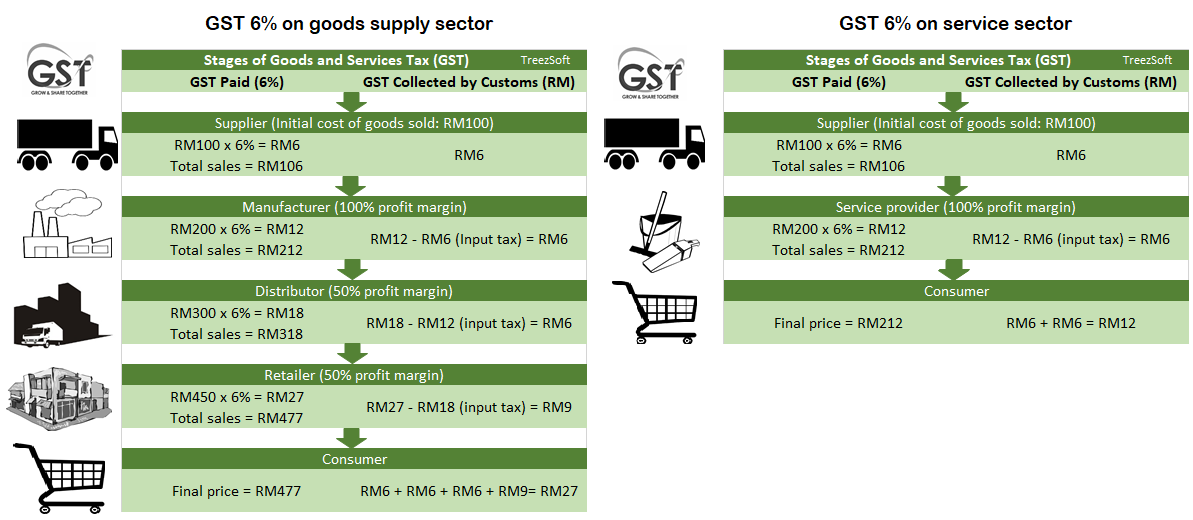

It is applied to all level of the production chain refer to Figure 1 hence it is often referred as. Malaysia Sales Service Tax - SST was re-introduced on 1 Sep 2018. This is the real question.

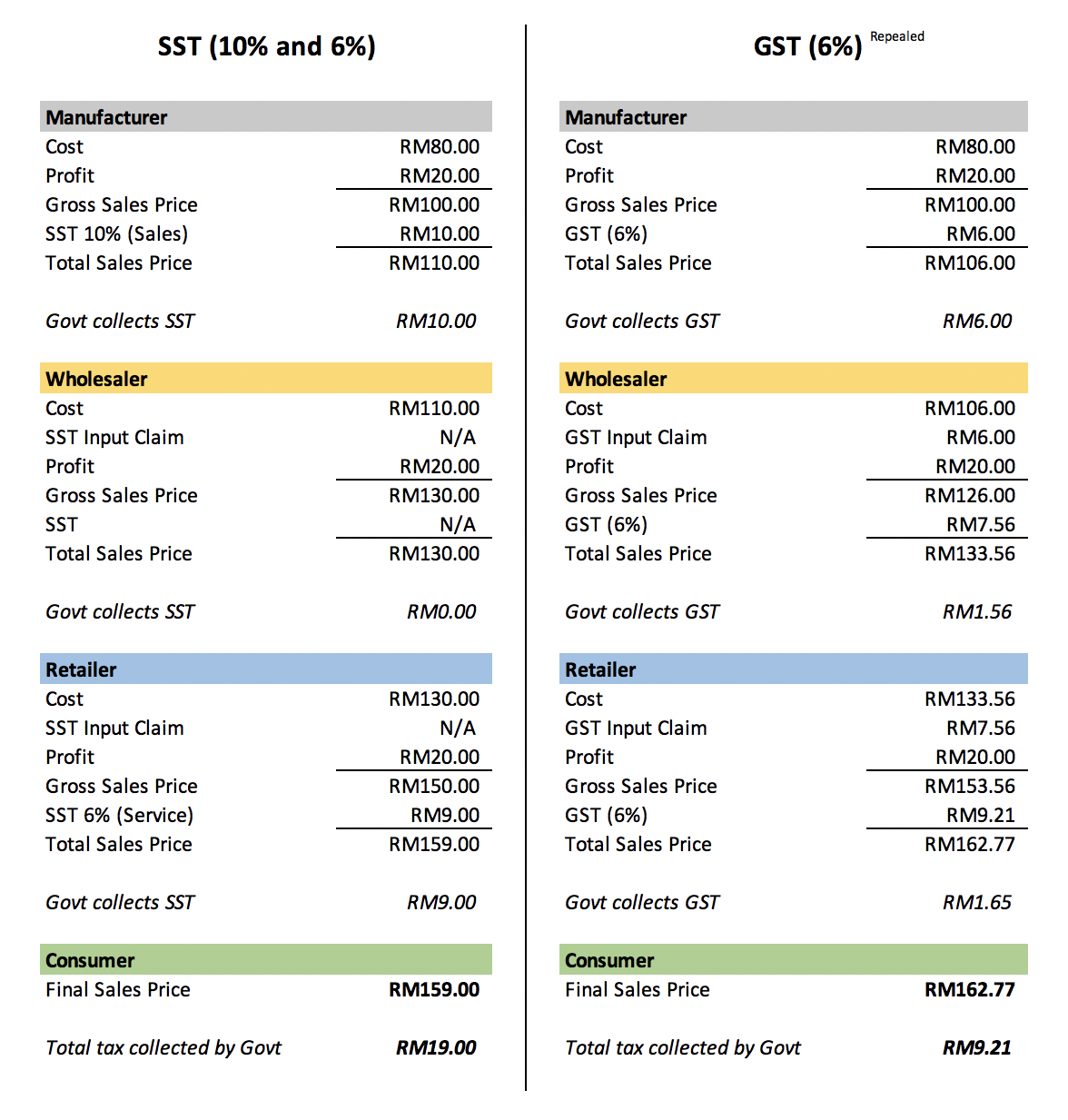

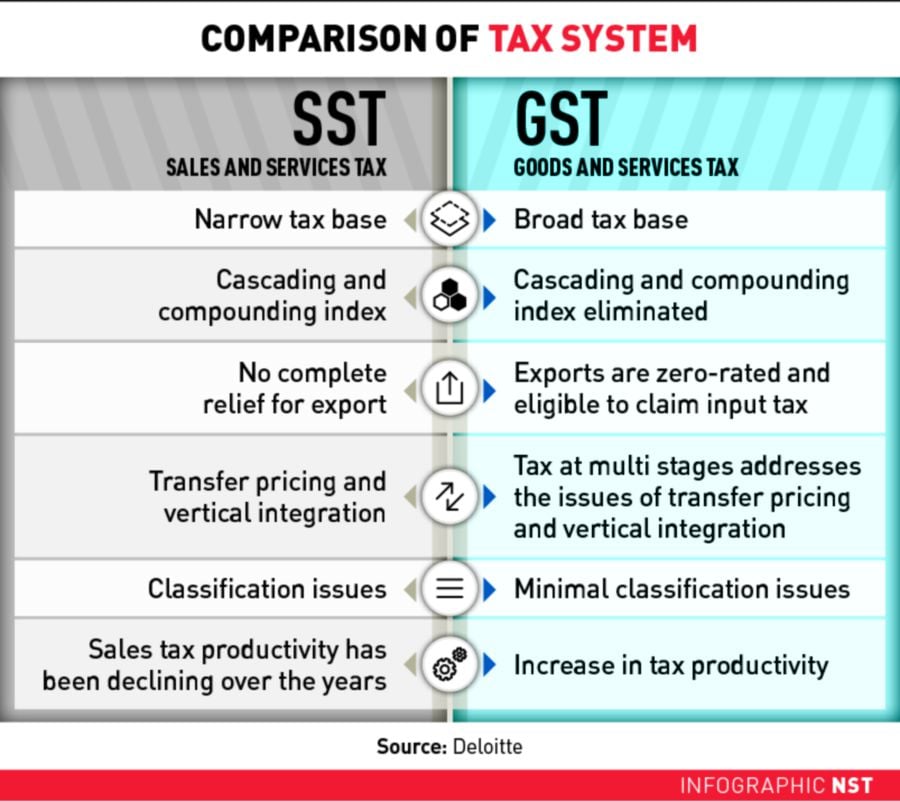

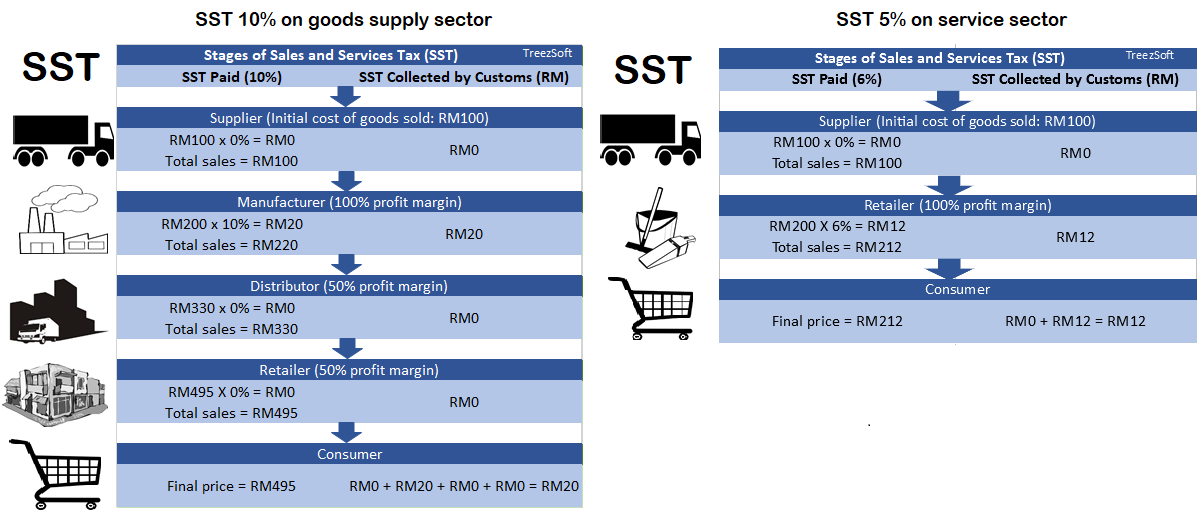

The sales tax is only levied on the level of the producer or manufacturer while the service tax is imposed on all customers who use tax services. Please refer to the table below for a comparison of two tax system. In effect it provides revenue for the government.

The Service Tax was governed by the Service Tax Act 1975 and this was also a federal consumption tax. Is GST better than SST. Both GST vs SST with these single stage taxes were abolished when Malaysias GST.

Comparison Between SST and GST. The standard rate of tax. The Sales and Service Tax SST reintroduction will be at a rate of 10 for the sales and 6 for the services.

GST is also charged on the importation of goods and services into Malaysia. The Goods and Services Tax GST is better than the Sales and Services Tax SST as GST collection is more than the latter which benefits the government businesses and the rakyat as a whole said economists. The GST regime has been in place since April 1 2015.

GOODS AND SERVICES TAX GST SALES AND SERVICE TAX SST Multi-stage tax. GST is a value added tax imposed on goods and services sold for consumers. GST has drawn quite a bit of flak over the years and public opinion is generally that GST has caused.

How is Malaysia SST Different from GST. SST will mean lower product prices vs SST will mean higher product prices. 2 days agoFriday 03 Jun 2022 1237 PM MYT.

SST refers to Sales and Service Tax. Consumers will have a choice in their consumption by paying service taxes based on their affordability and. The Sales Tax in Malaysia was a federal consumption tax that was introduced and implemented on a wide variety of goods and governed by the Sales Tax Act 1972.

The announcement was made by Lim Guan Eng Finance Minister on 16th July 2018. The SST rates are less transparent than the standard 6. SST is a federal consumption taxation policy that falls under Sales Tax Act 1972 in Malaysia.

The reintroduction of the Sales and Services Tax SST will see its rate set at 10 for sales and 6 for services. How SST VS GST in Malaysia can be evaluated. Homefinder Malaysia Malaysians are currently enjoying a three-month tax break between the zero-rating of GST and the re-introduction of SST.

The Star Malaysia. The standard rate of tax. Certain supplies are treated as zero-rated.

GST better than SST say experts. Same goes for the GST although obsolete shortly after introduction it is also a taxation policy on most goods and services sold for regular consumptions. GST stands for Goods and Service Tax and is implemented in Malaysia starting from 1st April 2015 to replace SST.

Find out everything you need to know about SST in Malaysia as a small business owner. An example below shows the differences between SST. The SST was initially replaced by the GST but it is making a comeback on 1st September 2018.

The move of scrapping the 6 GST has paved the way for the re-introduction of SST which will come into effect in 1 September 2018. Goods and Services Tax GST Sales and Service Tax SST Multi-stage tax.

Gst Vs Sst In Malaysia Mypf My

Gst Vs Sst In Malaysia Mypf My

How Is Malaysia Sst Different From Gst

Gst To Sst In Malaysia 3 Key Impacts Explained Infographic

Gst What Is Happening To Taxes In Malaysia Gst Vs Sst Treezsoft Blog

Difference Between Sst Gst Sst Vs Gst In Malaysia 2020 Updated

Sales And Service Tax Sst In Malaysia Transitional From Gst To Sst 2 0

Gst Better Than Sst Say Experts

Gst Vs Sst In Malaysia Mypf My

Gst Better Than Sst Say Experts

Comparing Sst Vs Gst What S The Difference Comparehero

Gst What Is Happening To Taxes In Malaysia Gst Vs Sst Treezsoft Blog

Abolition Of Gst And Transition To Sst In Malaysia Activpayroll

What Is Gst Goods And Services Tax Or Gst Is A Consumption Tax Based On Value Added Concept Unlike The Present Sales Tax Or Service Tax Which Is A Single Stage Tax Gst Is A Multi Stage Tax Payment Of Tax Is Made In Stages By Intermediaries In The

Gst Vs Sst Which Is Better Pressreader

Gst What Is Happening To Taxes In Malaysia Gst Vs Sst Treezsoft Blog

The Move From Gst To Sst Mcmillan Woods

Gst What Is Happening To Taxes In Malaysia Gst Vs Sst Treezsoft Blog