INLAND REVENUE BOARD OF MALAYSIA Date of Publication. 30000 with an HRA of Rs.

China Annual One Off Bonus What Is The Income Tax Policy Change

Calculate interest restriction automatically Monthly.

. 19 November 2019 1. Subsection 252 of Real Property Gains Tax Act 1967. Weve added a suspend lodgement function for tax returns that use the new UI.

For most corporate taxpayers the deduction generally will mean a federal income tax rate of 3185 on QPA income although certain oil- and gas-related QPA receive a less generous reduction that equates to a federal income tax rate of 329 for tax years beginning before January 1 2018. Government of Malaysia V MNMN. 15000 PM from his employer.

May not be combined with other offers. Valid receipt for 2016 tax preparation fees from a tax preparer other than HR Block must be presented prior to completion of initial tax office interview. Partnerships income is auto transferred to partners tax filing.

The tax year in Malaysia runs from 1st January to 31st December. Monthly Tax Deduction MTD 31 11. Malaysia offers a wide range of tax incentives ranging from tax exemptions allowances to enhanced tax deductions.

Use this feature to manage returns that arent due for lodgement until a later date. The deduction will be the lowest amongst. Page 1 of 32 PERQUISITES FROM EMPLOYMENT Public Ruling No.

Employers who do not use computerised payroll software can calculate the MTD using. Paragraph 11 2c Schedule 2 of Real Property Gains Tax Act 1967. Payment of monthly bill for internet subscription Under own name 2500 Restricted 11.

Purchase of breastfeeding equipment for own use for a child aged 2 years and. Deduction Claim By Employers 31 12. KSB V Ketua Pengarah Hasil Dalam Negeri.

10000 during the fiscal year 2017-18 the assessment year 2018-19. The deduction also applies in calculating the AMT. Lifestyle Purchase of personal computer smartphone or tablet for self spouse or child and not for business use.

Updates and Amendments 32 13. A sugary drink tax soda tax or sweetened beverage tax SBT is a tax or surcharge food-related fiscal policy designed to reduce consumption of sweetened beveragesDrinks covered under a soda tax often include carbonated soft drinks sports drinks and energy drinks. This deduction is an addition to the deduction granted under item 10.

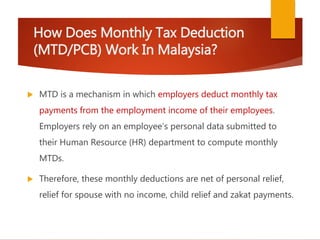

Offer period March 1 25 2018 at participating offices only. For employment income a monthly tax deduction MTD system is in operation whereby employers deduct monthly tax payments from the employment income of their employees. Pioneer Status PS is an incentive in the form of tax exemption which is granted to companies participating in promoted activities or producing promoted products for a period of 5 or 10.

Calculate Section 60F deduction automatically. Income Tax in Malaysia. Mr Verma employed in Mumbai is living in a rented accommodation and pays a monthly rent of Rs.

52019 INLAND REVENUE BOARD OF MALAYSIA Date of Publication. Case Report Stay of Proceeding. He receives a basic salary of Rs.

Generally tax incentives are available for tax resident companies. Fringe benefits tax return 2018 available. 19 November 2019.

Case Report Real Property Gains Tax. The Income Tax Act Section 10-13A provides for HRA exemption of tax. 14 February 2018 Suspend a tax return.

To qualify tax return must be paid for and filed during this period. This policy intervention is an effort to decrease obesity and the health impacts related to being overweight. With this release the new interface is now available for all annual returns in Xero Tax.

Sections 99 103 106 and paragraph 341 Schedule 5 of the Income Tax Act 1967. Income for joint assessment is automatically transferred to primary tax payer.

Cukai Pendapatan How To File Income Tax In Malaysia

Standard Deduction 2020 2021 What It Is And How It Affects Your Taxes Wsj

Irs Releases 2021 Tax Rates Standard Deduction Amounts And More

Chapter 4 Consumer Mathematics Taxation Flip Ebook Pages 1 28 Anyflip

Pdf A Study On The Monthly Tax Deduction As The Final Tax Amongst Malaysian Salaried Taxpayers Theory Of Planned Behaviour Approach

Malaysia Payroll And Tax Activpayroll

Simple Pcb Calculator Malaysia By Appnextdoor Labs

Monthly Tax Deduction Pcb Calculator Mypf My

How Does Monthly Tax Deduction Mtd Pcb Work In Malaysia

Tax Payer No 1 Amin Bin Adam Self Husband A Chegg Com

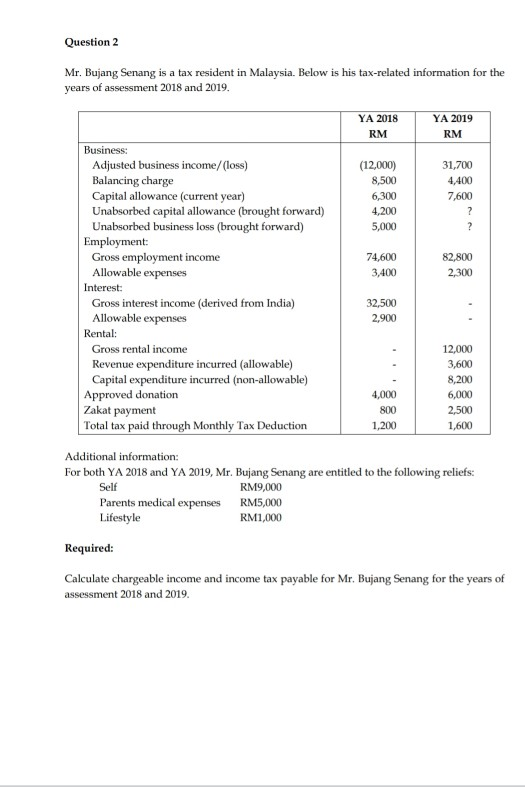

Question 2 Mr Bujang Senang Is A Tax Resident In Chegg Com

Personal Income Tax 2016 Guide Part 7

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

7 Tips To File Malaysian Income Tax For Beginners